Alphatec: Price Reversal Diverges From Economic Levers That Are Well In Situ (Rating Upgrade)

Investment briefing

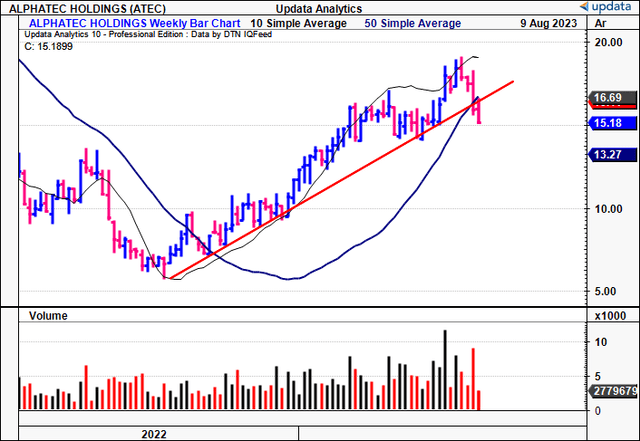

The equity stock of Alphatec Holdings, Inc. (NASDAQ:ATEC) has caught a 20% bid since my January publication. The stock rallied 12 months from July FY’22—’23 and then sold off quickly. This isn’t uncommon in smaller names, whereby distribution occurs at the 12-month mark within an upside leg given those long of the stock are no longer constrained by ST capital gains tax when taking profits. The company’s Q2 numbers don’t appear to be helpful here either, pushing through a deeper operating loss on ~40% YoY growth in revenues. Yet, on closer inspection, there was no deviation from the company’s long-term growth route, hence, there’s a chance the selloff is over-extended in my view.

Net-net, I revise my ATEC rating to buy given the profile outlined here. On asset factors and sales growth, the company has a propensity to rate to $20/share in my view. Revise to buy.

Figure 1. ATEC price evolution with selloff at 12-months post rally origination, also with Q2 numbers last week.

Critical facts to investment thesis

The investment debate is summarized into fundamental, sentimental and valuation factors in my opinion. I’ll run through each here, outlining the relevant points for each way. Specifically, on asset factors and sales data, ATEC appears as a qualified growth company. A more detailed appraisal is warranted to discern the investment value going forward.

1. Fundamental drivers

ATEC’s most recent numbers in Q2 FY’22 were strong and aligned with its trajectory to date. Revenues were up 39% YoY to $117mm on $1.5mm in adj. EBITDA and a net loss of $0.43.

Critically, the primary revenue driver is its surgical segment, where it books sales on delivery of its spinal implant products. These include pedicle screws, interbody units, plates, along with tissue-based biologics. It also books income from the sale of the medical imaging equipment used in the planning of surgery and post-op review. Procedure-wise, its main revenue drivers are the prone transpsoas (“PTP”) procedure, anterior lumbar interbody fusion (“ALIF”), and lateral transpsoas (“LTP”) procedures.

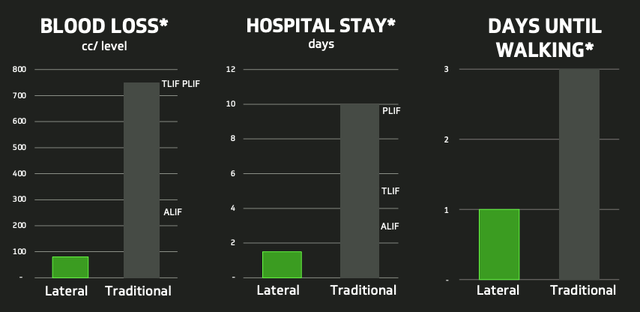

The LTP offering has promise in my view. From my many discussions with orthopaedic surgeons and hospital executives over the years, what I dub as patient economics are factored heavily into all decision-making on surgery preference. First, the efficacy and safety of the procedure are paramount. Patient outcomes are top priority, for obvious reasons. But adjacent to that, length of procedure (to increase surgeries/day), length of recovery, blood loss/infections, and, time before discharge are all factored highly.

That is, shorter surgery time, shorter recovery, less bloods/infections, and quicker discharge. These all mean the surgeon can complete more surgeries in a set time period, ultimately driving higher income for surgeon and hospital. The LTP procedure looks to offer this kind of profile, which talks to the patient economics I mentioned. Figure 2 is taken from its Q2 investor presentation, and highlights the potential benefits compared to conventional spinal surgery techniques. This is due to the access point being through the psoas muscle (also known as the hip flexor, and located in front of the spinal column). You’re avoiding a large incision through the anterior or posterior tissues of the abdomen this way—much less invasive.

Figure 2.

It is for good measure that the LTP has surgeon attractiveness too. The key economic levers for ATEC—for all its portfolio—are converting new surgeons, growing the number of surgeries from its existing base, and adding new products/procedures to expand its markets. This has the potential to create an attractive economic flywheel in my view. Why?

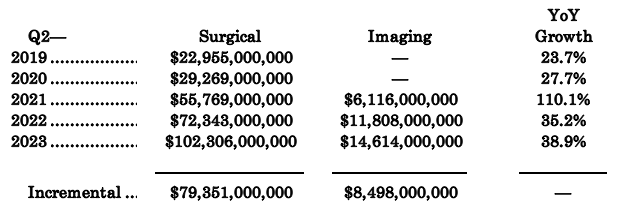

One, ATEC’s top-line growth qualifies it as a legitimate growth company in my view. Just taking the Q2 numbers from FY’19—’23, quarterly revenues are up $79.3mm from surgeries, and up $8.5mm from imaging (note: imaging recorded from 2021 on its introduction). Net-net, it did $102mm of business from surgeries last quarter, up ~40% YoY. Further, procedural volumes were up 32% YoY, with average revenue per case up 7% as well.

Figure 3.

Two, with the growth in operating assets (total assets less cash + marketable securities) delivered from its business returns so far, it has circled back ~$0.15 per $1 in assets back in gross over Q2 FY’21. It now sees ~$0.50 in gross capital productivity on each $1 of capital tied up into its asset base [Figure 4].

It has grown operating assets by $364.4mm across this time, and produced an additional $33.1mm in quarterly gross profit ($102.7mm in TTM figures). This equates to a 9% incremental gain in gross capital productivity, or 28% on a TTM basis (102.7/364.4 = 0.28). As such, we have a scenario, where as the business expands—from an asset growth perspective—the gross profit it produces on this is matching the speed of growth. If gross profitability scaled by ATEC’s assets was lagging, I would be a little more concerned.