Economic Challenges Meet Everbridge (Rating Downgrade)

Introduction

You know, sometimes a company can whip up a stellar product, but when it comes to cashing in on it or scaling up, things get tricky. That’s been the story of Everbridge (NASDAQ:EVBG). The company has successfully developed a critical events management platform that helps companies and governments in responding quickly and effectively to critical events, such as natural disasters and terrorist attacks, as I highlighted in my previous article. The company has attracted impressive customers.

But here’s the catch: Everbridge’s management has been scratching their heads on how to turn that into financial gains. Their revenue growth, let’s just say, hasn’t been breaking any records. And in my view, their recent quarterly results, instead of easing those worries, have likely added fuel to the fire.

Earnings Recap

Diving straight into Everbridge’s second quarter results released this past Tuesday, the company’s Annualized Recurring Revenue (ARR) reached $395 million. This is a 2% uptick from Q1-2023 and a 9% rise from Q2-2022. Everbridge outperformed both top and bottom-line expectations. Revenues surged by 7.4% to $110.6 million, surpassing analyst projections. Adjusted EBITDA witnessed a significant jump from $4.8 million the previous year to $18.3 million this quarter. Likewise, adjusted net income grew from $0.03 per share in Q2-2022 to $0.31 per share in Q2-2023, a figure that exceeded the analysts’ forecast of $0.27 per share. A notable achievement was their cash flow: Everbridge posted a positive operational cash flow of $5.4 million, a remarkable improvement from the negative $9.9 million last year. Factoring out a singular cash payment, the company’s free cash flow was $1.6 million.

However, there were worrying signs as well. Everbridge reported another net loss on a GAAP basis, with a Q2-2023 loss of $0.37 per share, albeit better than the $0.91 loss from the previous year. On the brighter side, while the adjusted income guidance remains unchanged, the forecasted GAAP loss for 2023 has been reduced: from about $1.145 per share to a slightly improved $1.045 per share. A significant development was the company’s revised revenue guidance for the year. The projection now stands at a growth rate of 4% to 5%, translating to an approximate revenue of $451 million. This is a slide from the earlier anticipated 6% to 7% growth, amounting to around $459 million.

Tough Outlook

In my opinion, Everbridge’s financial results were mixed, with a slight inclination towards the negative spectrum. Their outlook, particularly concerning GAAP net loss and operating loss, remains less than optimistic. The firm recorded an operating loss of $15.4 million for Q2-2023, albeit better than the previous year’s $36.1 million.

However, both GAAP and adjusted margins got better in the first six months of this year. Adjusted EBITDA margin for H1-2023 clocked in at 15.6%, up from 3.6% the previous year. Net loss margin also saw improvement, decreasing to 13.6% in H1-2023 from last year’s 27.2%. With a prudent financial approach, Everbridge registered $15.9 million of free cash flows in the first half of this year, even after accommodating a $5.6 million payment associated with its strategic realignment. The company’s efforts to realign cost structure and improve efficiencies is bearing fruit.

While Everbridge appears to be making progress, its pace of growth seems tepid. The company’s challenge remains its inability to boost revenues significantly or to post consistent profits. The extent of this challenge becomes strikingly clear when evaluating the firm’s performance through the lens of the ‘Rule of 40,’ which dictates that the combined figure of a company’s revenue growth rate and its profit margin should reach at least 40 for a healthy SaaS company.

Over the past three years, Everbridge has consistently fallen short of this 40 benchmark. Even if one were to gauge their performance using the more favorable adjusted EBITDA margin (as opposed to the negative unadjusted EBITDA margin), the story remains similar. In H1-2023, the combined metric of revenue growth and adjusted EBITDA margin was 23, considerably below the ideal point.

Over the past three years, Everbridge has consistently fallen short of this 40 benchmark. Even if one were to gauge their performance using the more favorable adjusted EBITDA margin (as opposed to the negative unadjusted EBITDA margin), the story remains similar. In H1-2023, the combined metric of revenue growth and adjusted EBITDA margin was 23, considerably below the ideal point.

This underwhelming performance isn’t entirely unforeseen. According to Everbridge’s strategic long-term roadmap, the company doesn’t anticipate reaching or surpassing the ‘Rule of 40’ until at least 2027.

A decade-long trend reveals consistent GAAP operating losses for Everbridge, as per data from Seeking Alpha. This year seems to be following suit, with losses projected to decrease yet still persist. The cloud of reduced revenue growth looms large, and investors might need to recalibrate expectations for the forthcoming quarters.

As previously highlighted, Everbridge has reduced its revenue growth projection, a forecast that was already conservative to begin with. This implies investors should brace for even diminished revenue growth in the forthcoming quarters.

For 2023, Everbridge projects its revenues to grow by approximately 4.5%, as per the mid-point of its revised guidance. It’s worth noting, however, that the company has already recorded a more robust revenue growth of 7.6% during the initial half of 2023. This signifies an anticipated tapering of growth as we transition into the latter half of the year. The revenue guidance for the third quarter from Everbridge suggests a YoY growth deceleration to 2%. Extrapolating this trend indicates potential revenues of about $118.4 million in Q4-2023, translating to a mere 1.1% YoY growth.

This projected slowdown in growth trajectory can be attributed primarily to two critical factors. The first pertains to Everbridge’s strategic shift towards prioritizing subscription revenues over non-recurring streams, such as perpetual licenses. To facilitate this transition, the company has made modifications to its sales incentives, a move expected to result in a decline in non-recurring revenues.

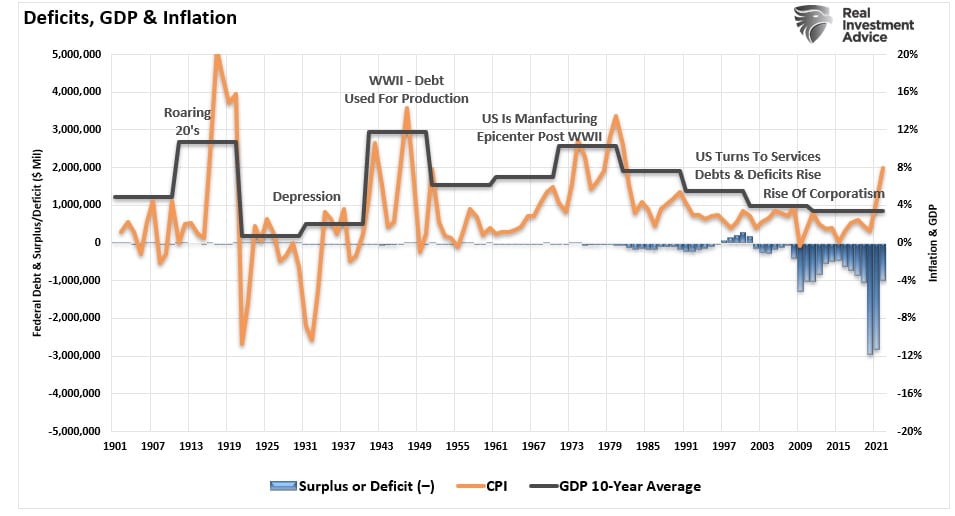

The second, and arguably more concerning factor, stems from the prevailing challenging macroeconomic environment, characterized by high inflation and elevated interest rates that is eating into corporate profits. These conditions have engendered a sense of caution among businesses, with many opting to curtail their expenditures.

Within the daunting economic landscape, Everbridge finds itself grappling to onboard clients willing to commit to substantial deals exceeding $100,000. To provide context, in Q2-2022, the company sealed 12 deals each surpassing the $500,000 mark. In stark contrast, this number dwindled to a mere three in Q1-2023, and further plunged to just one in Q2-2023.

So far, in spite of the tough conditions, Everbridge has managed to grow its ARR, which is one of the key metrics to measure the company’s performance, on both the YoY and sequential basis. However, the future paints a more challenging picture. If the business environment doesn’t show tangible improvements, the company’s already wavering revenue growth may exert additional strain on its ARR.

Furthermore, Everbridge’s hurdles in navigating the current economic conditions cast shadows of doubt over its objective to fulfill the ‘Rule of 40’ by 2027. If we hypothesize a scenario where revenue growth decelerates even more in 2024, especially considering the projection of a mere 1% growth in Q4-2023, Everbridge might need to recalibrate and extend its long-term target.

It’s, however, crucial to note the silver linings as well. The company has managed to improve earnings, reflected both in GAAP and non-GAAP results. This might evolve into a consistent upward trend, pushing Everbridge towards profitability, especially if it doubles down on cost-cutting and efficiency measures. Furthermore, Everbridge’s strategic pivot towards recurring revenues, though possibly a short-term hit to both the top and bottom line, holds promise. It could bring stability to revenues, earnings, and cash flows, which can make it more resilient to business cycles. On the broader economic canvas, should the US economy rebound in the upcoming quarters, there’s potential for Everbridge to regain its momentum and clinch lucrative contracts.

However, at this juncture, it’s my belief that the near-term headwinds may overshadow these positive indicators. I remain cautiously observant, awaiting concrete signs of turnaround before reconsidering my stance.

Takeaway

In its most recent quarter, Everbridge surpassed both revenue and earnings estimates. However, the company has been battling the dual challenges of tepid revenue growth and financial losses. While there has been a commendable enhancement in its bottom-line this year, on a GAAP basis, the company still finds itself in the red. The current outlook appears daunting, with revenue growth showing signs of fatigue, in part, influenced by the broader macroeconomic conditions. This may significantly impede the company’s performance in the near future.

In its most recent quarter, Everbridge surpassed both revenue and earnings estimates. However, the company has been battling the dual challenges of tepid revenue growth and financial losses. While there has been a commendable enhancement in its bottom-line this year, on a GAAP basis, the company still finds itself in the red. The current outlook appears daunting, with revenue growth showing signs of fatigue, in part, influenced by the broader macroeconomic conditions. This may significantly impede the company’s performance in the near future.

Everbridge’s stock value has seen a 30% dip over the past half-year, and there’s a likelihood of it continuing to tread in this subdued trajectory throughout the year. Given these insights, I am revising my stance on the stock to ‘sell’. I would advise investors to cast their nets wider and seek more promising investment avenues elsewhere.

Click here to view original web page at Economic Challenges Meet Everbridge (Rating Downgrade)